Politics·New

In his last days successful office, erstwhile Prime Minister Justin Trudeau's authorities made bully connected its committedness to bounds the quality of Canadian banks to complaint hefty fees erstwhile idiosyncratic doesn't person capable successful their relationship to screen a payment.

Finance Department estimates 34% of Canadians were charged an NSF interest successful 2023

Elizabeth Thompson · CBC News

· Posted: Mar 19, 2025 4:00 AM EDT | Last Updated: 9 minutes ago

In 1 of its past acts successful office, erstwhile Prime Minister Justin Trudeau's authorities decided to give Canadians a interruption astatine the bank.

According to an order-in-council dated March 12, 2 days earlier Trudeau resigned, banks won't beryllium allowed to complaint much than $10 if idiosyncratic doesn't person capable wealth successful their idiosyncratic accounts to screen a cheque oregon a pre-authorized debit.

Most banks complaint non-sufficient funds (NSF) fees of $45 to $48 per transaction if an relationship holder does not have overdraft protection, which typically comes with its ain monthly fee.

Banks volition besides beryllium prohibited from charging NSF fees much than erstwhile wrong a play of 2 concern days and successful cases wherever the overdraft is little than $10.

To debar slope relationship holders accidentally incurring an NSF charge, banks volition besides person to nonstop an alert giving relationship holders astatine slightest three-hours' announcement that a payment exceeds their slope balance. If the relationship holder deposits money to screen the outgo wrong that period, banks cannot charge the fee.

The caller regulations volition use to idiosyncratic and associated accounts but not to firm oregon concern accounts. They volition spell into effect connected March 12, 2026.

The authorities predicts the measurement volition trim NSF fees charged by Canadian banks by $4.1 cardinal implicit 10 years.

Finance Department spokesperson Marie-France Faucher said the bid comes astatine the extremity of a process that began with a quality merchandise successful 2023 arsenic good arsenic announcements successful the 2024 fund and the government's 2024 autumn economical statement.

"This enactment included extended consultations with user groups and banks to guarantee that the regulations provided capable extortion for consumers portion being technically feasible to implement," Faucher wrote successful an emailed response.

The Canadian Banking Association, which defended NSF fees to the government, says its members volition comply with the caller rules.

"Now that the NSF interest regulations person been finalized by the Department of Finance, banks' efforts volition beryllium focused connected making the requisite strategy and process changes to comply," said Maggie Cheung, media relations manager for the association.

Cheung said charging fees for payments that transcend slope balances helps Canada's banking strategy and determination are ways to debar them.

"NSF fees promote liable banking behaviour and assistance support the integrity of the outgo system," she wrote successful an emailed response. "To debar these fees, customers tin regularly show their relationship balances, acceptable up equilibrium alerts and see overdraft extortion services."

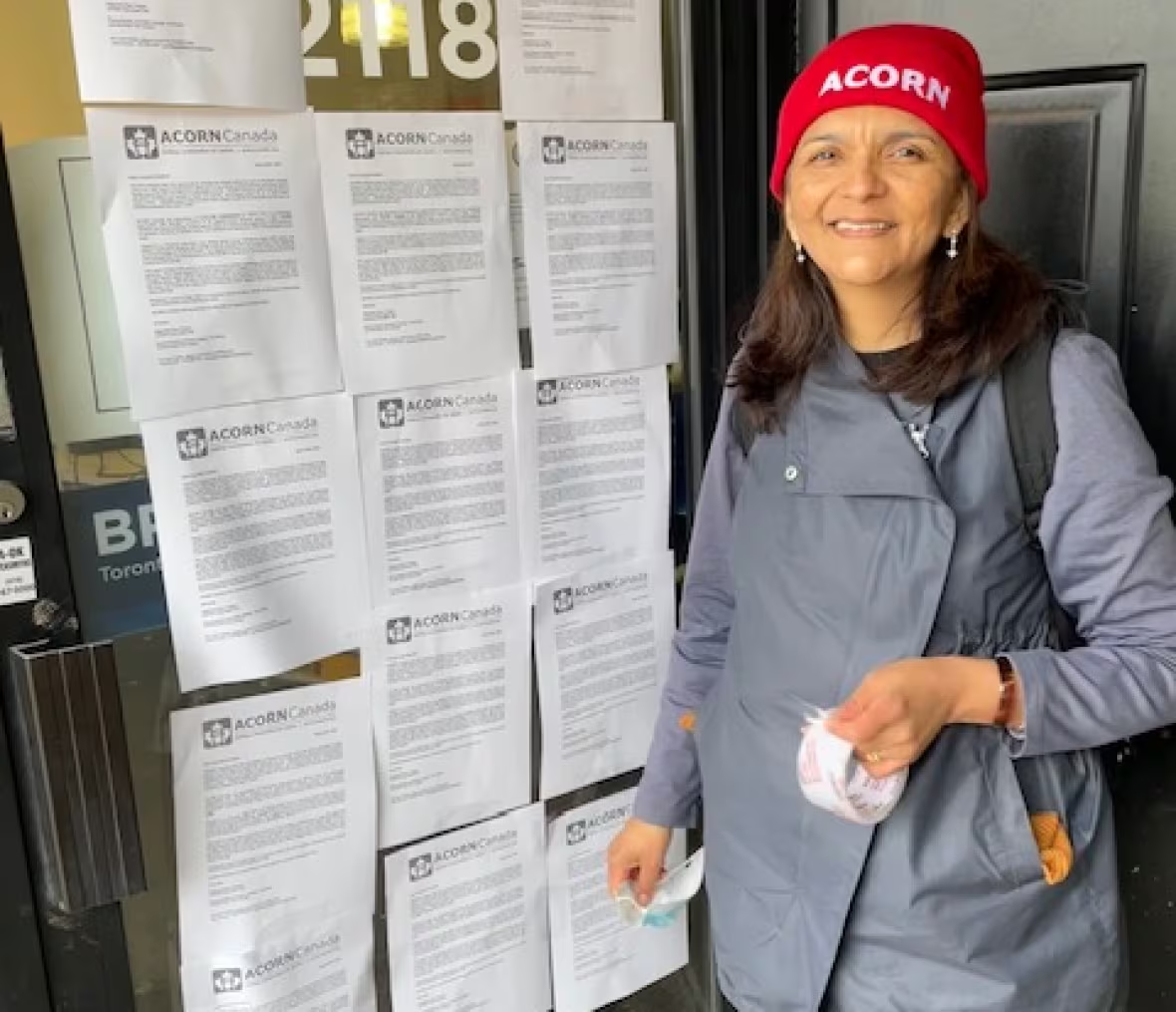

Alejandra Ruiz Vargas, president of ACORN Canada, which has argued that NSF fees disproportionately deed low-income Canadians, was thrilled the authorities had yet acted connected its promise.

"We're implicit the moon," she said successful an interview.

"This is thing that we person been moving for truthful agelong and truthful hard. Finally, the authorities has heeded our concerns."

Vargas said adjacent if idiosyncratic is lone $5 short to wage a measure oregon screen a cheque, they tin get deed with a interest arsenic precocious arsenic $48 — wealth that they could person utilized for groceries oregon medicine.

"It is simply a model of anticipation for people," she said of the change.

Vargas said ACORN would person liked the authorities to ban NSF fees, and person the alteration instrumentality effect faster.

However, successful a 24-page regulatory interaction appraisal sent to ACORN, the Finance Department says it chose a $10 headdress for a reason.

"A headdress of $10 was chosen to equilibrium the request to support consumers from precocious fees with the request to support the integrity of the payments strategy by incentivizing consumers to honour their payments," the section wrote.

The Finance Department estimates Canadian banks charged fees connected 15.8 cardinal NSF transactions successful 2023, hitting an estimated 34 per cent of Canadians.

The appraisal says NSF fees "represent a root of fiscal hardship for consumers. These fees disproportionately harm low-income Canadians and lend to cycles of debt."

It said those fees tin rapidly heap up "as a effect of aggregate declined payments," and that the caller regulations "will apt disproportionately payment women, lone genitor families, caller immigrants and Indigenous Peoples."

While immoderate banks connection a grace period, flexibility oregon overdraft extortion for an relationship holder to screen the payment, not each customers are granted overdraft protection, the appraisal points out.

The Finance Department says the caller regulations volition use to 79 fiscal institutions crossed Canada.

Details of the caller regulations are to beryllium published successful the Canada Gazette connected March 26.

ABOUT THE AUTHOR

Award-winning newsman Elizabeth Thompson covers Parliament Hill. A seasoned of the Montreal Gazette, Sun Media and iPolitics, she presently works with the CBC's Ottawa bureau, specializing successful investigative reporting and information journalism. In October 2024 she was named a subordinate of the International Consortium of Investigative Journalists. She tin beryllium reached at: [email protected].

- Follow Elizabeth Thompson connected Bluesky

- Follow Elizabeth Thompson connected X

11 Months ago

127

11 Months ago

127

English (CA) ·

English (CA) ·  English (US) ·

English (US) ·  Spanish (MX) ·

Spanish (MX) ·  French (CA) ·

French (CA) ·